Check out the recent article published about our agency in a local newspaper:

AIA Insurance Services

These days, finding great customer service can be a challenge. Many online “bargains” turn out to be not-so-smart purchases when you need service after the sale, and get stuck in a cycle of phone calls that get you nowhere.

AIA Insurance Services is a modern company with traditional values. “Our customers are the entire reason we are in this business,” said Tom Torgersen, the company’s president. “We put them first and do our best to provide excellent service as well as competitive rates.”

AIA is a full-service, independent insurance agency located in the Dolphin Village shopping plaza in St. Pete Beach. They are available Monday through Friday to help you in their office or by phone. Tom and his team are appointed with many different carriers for all types of insurance, from health and life to home owners, flood, auto and more.

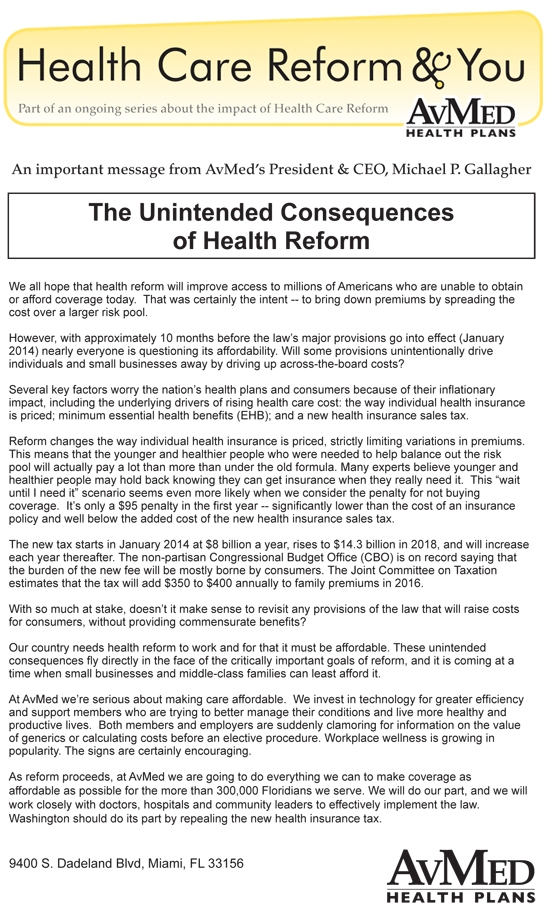

“We’re busy planning ahead for the Open Enrollment season in healthcare,” Tom said. “Many of our groups renew in the fourth quarter, so we’re gathering quotes and looking for ways to save them money. We’re also taking continuing education classes and obtaining the necessary certifications to guide consumers through the confusing new world of individual health insurance, both on and off the Federal health insurance marketplace,” he said.

With the new health care reform law, or ObamaCare, in effect, the rules have changed regarding when you can apply for an individual health plan. Open Enrollment will run Nov. 15, 2014 through Feb. 15, 2015, for the 2015 calendar year. This period is the only time you can apply for non-group health insurance – UNLESS you have lost coverage due to a qualifying life event such as a divorce or loss of a job. If you lose coverage, you become eligible for a Special Enrollment period spanning 60 days from your loss of coverage.

Medicare Open Enrollment is Oct. 15 through Dec. 7, 2014, for the 2015 calendar year. This is when you can add or change your coverage, or choose to sign up for a Medicare Advantage plan to supplement your benefits. The exception to this rule is, of course, when you “age in” to Medicare on your 65th birthday. Recent census data show 10,000 Baby Boomers become eligible for Medicare every day! Are you one of them?

AIA Insurance Services is located at 4615 Gulf Blvd., Suite 104, St. Pete Beach. They are conveniently located in the same plaza as Publix®. Their office is open Monday through Friday, 8am-5pm. Please call 727-577-7222 or for more information.

By SUSAN TAYLOR MARTIN and RICHARD DANIELSOLN

By SUSAN TAYLOR MARTIN and RICHARD DANIELSOLN